In a country where many borrowers without access to formal financial institutions are forced to offset decades-old loans by marrying their female family members off to predatory private lenders, the importance of financial inclusion cannot be overemphasised.

In a country where many borrowers without access to formal financial institutions are forced to offset decades-old loans by marrying their female family members off to predatory private lenders, the importance of financial inclusion cannot be overemphasised.

After all, Pakistan ranks embarrassingly low not just internationally, but also regionally, as far as access to formal sources of finance is concerned, according to the World Bank’s Financial Inclusion Database 2012.

It estimates that only 10.3% Pakistani adults maintain an account at a formal financial institution compared to the global average of 50.5%. The corresponding figure for all South Asian economies, which include Afghanistan, Bangladesh, India, Nepal and Sri Lanka, is 33%.

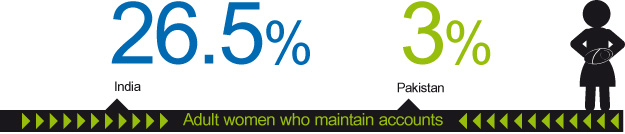

It gets worse in the case of Pakistan’s female adults: a mere 3% of them have an account at a formal financial institution whereas the comparable figure for India, for example, is 26.5%.

Surprisingly, the problem of low exposure to formal sources of finance is not restricted to marginalised population groups like women or the poor. The World Bank estimates that only 14.3% of Pakistanis in the third, fourth and fifth quintiles of income – i.e. the relatively well-off segment of the national population – maintain a formal bank account. The comparable figure for India is 44.4%, according to the Financial Inclusion Database 2012.

“The explanation for the fact that a majority of Pakistanis is still without a formal bank account can be found in the composition of our gross domestic product (GDP). A large number of people belonging to the agriculture sector continue to stay away from formal financial institutions,” said Emerging Economics Managing Director Muzammil Aslam while speaking to The Express Tribune.

Although the agriculture sector accounts for 21% of GDP, the Pakistan Economic Survey 2011-12 says it generates 45% employment in the country.

Aslam says people working in many sub-sectors within the GDP’s services sector – which employs 34.9% of the labour force as per the CIA’s World Factbook – are also able to avoid taxes by choosing to stay away from formal modes of financing. For example, the largest sub-sector of the services sector – transport, storage and communication – is crammed with tax evaders.

“Most drivers in the transportation sector receive their salaries in cash from vehicle owners. Nobody tells them that they should open bank accounts to be part of the formal financial system,” Aslam says.

The World Bank estimates that only 4.6% of Pakistanis saved any money for emergencies in the past one year compared to 18% Indians, who set aside some amount for the same reason last year. On the flip side, 17.1% Pakistanis reported that they had an outstanding loan for health or emergencies as opposed to 14.2% Indians who had an outstanding loan for the same reasons.

The comparison suggests that while Indians tend to save more and borrow less when an emergency strikes, Pakistanis save little and borrow heavily for unforeseen events.

“Indians have done major tax reforms in the last decade or so, which has improved their access to finance,” Aslam said. “Unlike expatriate Pakistanis, a non-resident Indian cannot even think about sending home remittances through informal channels, which has eventually resulted in connecting more people to the banking sector,” he added.

Published in The Express Tribune